Driving in California isn’t just about sunny highways and weekend getaways — it comes with serious legal responsibilities. If you’re a driver in Brentwood, understanding the minimum car insurance requirements is more than just smart — it’s required by law. And as of

Whether you’re renewing your policy or buying insurance for the first time, it’s important to know what’s legally required, what it means for your financial protection, and how to make sure you’re truly covered, not just compliant.

Let’s break it down.

As of

This is a significant jump from the previous minimums of $15,000 / $30,000 / $5,000/.

So, what do these numbers actually mean for you as a driver?

1. Bodily Injury Liability (BI)

This pays for injuries to other people if you’re at fault in a car accident. The coverage includes medical bills, lost wages, and even legal fees if the injured party sues.

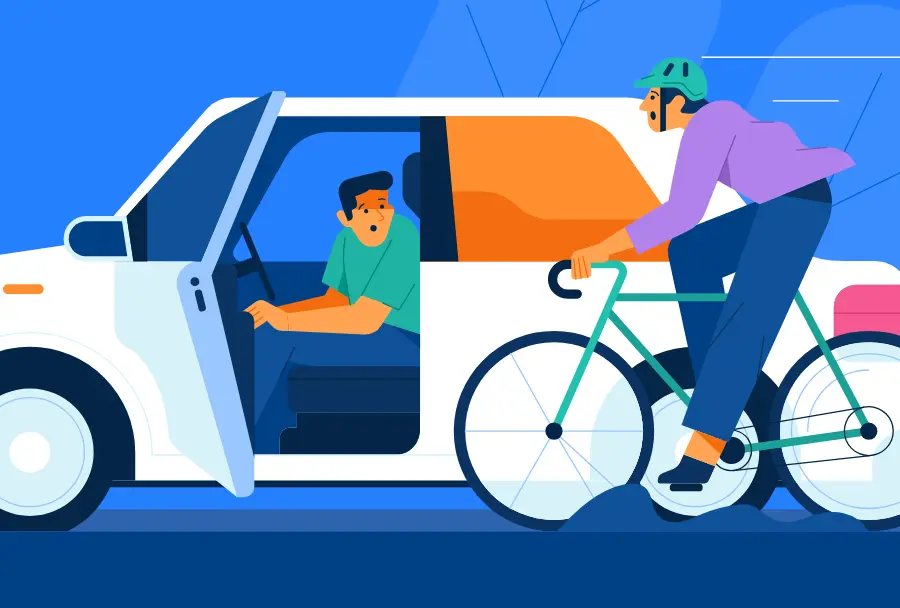

2. Property Damage Liability (PD)

This pays for damage you cause to someone else’s property — whether it’s their car, fence, garage, or storefront.

These are liability-only coverages, meaning they don’t pay for your injuries or your car. That’s where many drivers in Brentwood run into trouble: having minimum coverage may keep you legal, but it may not fully protect you.

The short answer? Not always.

Let’s say you cause a multi-car collision in downtown Brentwood. Three people are injured. Medical bills can easily exceed $20,000 per person, especially if hospital stays or surgeries are involved. Your $60,000 per accident cap might run out fast, and once your policy is maxed, you’re on the hook for the rest.

The same goes for property damage. If you crash into a newer car, $15,000 might not even cover the bumper, let alone if you hit multiple cars, a storefront, or city property.

That’s why many drivers in the area choose to go beyond the minimum and explore better options through auto insurance providers in Brentwood CA, like Circadian Insurance.

Even though you’re only legally required to carry liability coverage, it’s often wise to consider optional add-ons that can protect your health, your car, and your finances. Here’s what you might want to include:

Collision Coverage

Covers damage to your own vehicle if you’re in an accident, regardless of who’s at fault.

Comprehensive Coverage

Protects against non-collision incidents like theft, vandalism, weather damage, or hitting an animal.

Uninsured/Underinsured Motorist (UM/UIM)

If another driver hits you and doesn’t have insurance — or doesn’t have enough — this coverage can step in.

Medical Payments or Personal Injury Protection (PIP)

Covers your medical expenses or your passengers’, regardless of fault.

Roadside Assistance and Rental Reimbursement

While not essential, these can save you a lot of hassle in emergencies or while your car is in the shop.

Circadian Insurance offers personalized policies that fit your lifestyle, so you’re not paying for coverage you don’t need, but you’re also not left exposed when it matters most.

Driving without the minimum insurance in Brentwood or anywhere in California is a serious offense. If you’re caught without proper coverage, you could face:

Beyond the legal trouble, driving uninsured puts you at enormous financial risk. One accident — even a minor one — can create lasting consequences.

Insurance premiums vary based on:

That said, Brentwood drivers can expect liability-only policies to be less expensive upfront than full coverage, but again, you get what you pay for. For those with teen drivers, newer vehicles, or higher risk factors, a tailored policy through a local broker can be a better long-term strategy.

Circadian Insurance works with top carriers and compares rates for you, making sure you get value, not just compliance.

Brentwood isn’t just another California town — it has its own unique mix of suburban growth, commuter traffic, and seasonal wildfire risk. A local insurance broker understands:

Most importantly, a local broker gives human support when you need it most. Filing a claim? Switching carriers? Circadian Insurance is just down the road, not across the country.

If you’re driving in Brentwood, California, the minimum car insurance you need is:

But that’s just the legal minimum. It may not be enough to truly protect you, your family, or your financial future. Consider exploring your options with a reliable provider of auto insurance in Brentwood CA, like us, to ensure you’re covered where it counts.

Circadian Insurance offers personalized advice, competitive rates, and deep knowledge of Brentwood’s local insurance needs. Whether you’re shopping for a better policy, need help navigating new laws, or just want peace of mind, we’re here to help.

Don’t wait for an accident to find out you’re underinsured.

Reach out today and get covered the right way.